Ethereum ETFs Smash Records with $333M Inflows, Surpassing Bitcoin

Spot Ethereum ETFs in the U.S. saw record inflows, signaling a renewed investor interest in the second-largest cryptocurrency after a year of underperformance compared to Bitcoin.

By Tylt Editorial Team

Ethereum ETFs recorded $333M in inflows during a shortened trading session.

BlackRock and Fidelity led the surge with significant investor interest.

ETH outperformed Bitcoin on a weekly and monthly basis, reaching $3,700.

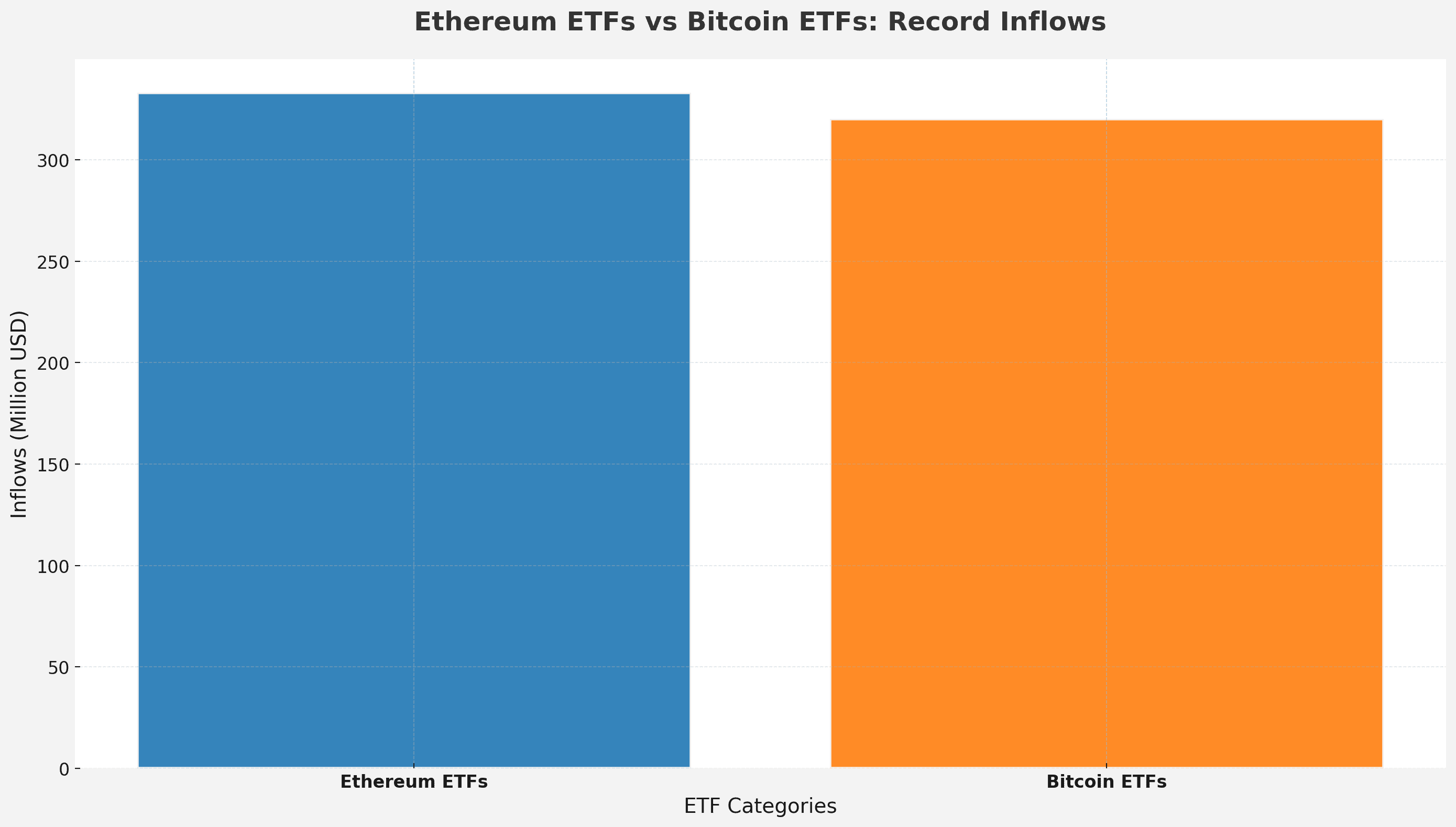

Ethereum exchange-traded funds (ETFs) in the United States experienced an unprecedented surge in inflows, booking $332.9 million in net investments during a shortened Friday trading session. The rally reflects a growing sentiment among investors that the second-largest cryptocurrency is poised for a significant catch-up after trailing Bitcoin throughout the year.

Major players like BlackRock’s iShares Ethereum Trust and Fidelity’s Ethereum Fund were at the forefront of the inflow frenzy, capturing $250 million and $79 million, respectively. This marks the fifth consecutive session of net inflows for Ethereum ETFs and concludes the second-strongest week on record, with $455 million in cumulative inflows. The momentum is particularly noteworthy, considering the week included Thanksgiving Thursday, a market holiday.

Ether’s performance stood out even more when compared to Bitcoin ETFs, which saw $320 million in inflows on the same day but ended the week with net outflows. This divergence signals Ethereum’s growing appeal, fueled by increasing interest in altcoins and decentralized finance (DeFi) applications following Donald Trump’s recent election victory.

Beyond ETFs, institutional demand for Ethereum appears robust, with open interest for ETF futures on the Chicago Mercantile Exchange (CME) reaching a record high of nearly $3 billion. These metrics underscore a resurgence in optimism toward Ethereum, further bolstered by its strong price action.

On Saturday, ETH hit a five-month high, climbing above $3,700 and outpacing Bitcoin on weekly and monthly timeframes. However, year-to-date performance still lags behind its larger counterpart. Analysts suggest that the ETH-BTC ratio may be forming a major bottom after three years of decline, potentially heralding a sustained reversal in trend.

Market strategists highlight a shifting regulatory climate under the incoming U.S. administration as a pivotal factor in Ethereum’s comeback. With a clearer investment path and renewed confidence in DeFi, Ethereum is reclaiming its place in investors’ portfolios.

As crypto trader Edward Morra noted, Ethereum now represents "the most obvious catch-up trade of this cycle," signaling that the market’s renewed focus on the asset could extend its rally further.